How do you calculate borrowing capacity

Its calculated based on your basic financial information such as your income and. However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate.

Credit Card Payoff Calculator Credit Card Debt Paying Off Ideas Of Credit Card Debt Pa Credit Card Payoff Plan Paying Off Credit Cards Credit Card Interest

Theres also two calcuations that most.

. Here are 11 ways to increase your borrowing power to buy a better home. Do you want to know how to calculate your borrowing capacity for residential home loans. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Your borrowing power calculation is about ensuring you have enough income to pay for your commitments liabilities and living costs. No credit check is involved nor is it a guarantee of the approved financing which you may. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Buying or investing in. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Budget Planner Selling and buying real estate made easy by AQ Properties Call us on 02 8733 2083 for a chat and some helpful advice.

While there is a standard formula lenders follow lenders may assess your income or expenses. Compare home buying options today. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider.

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus. Get Your Loan In 24 Hours.

However the actual amount you can borrow depends on your credit score total income and other loan amounts. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Even if this is not the only element taken into consideration it is of capital importance.

Fixed rates for the life of the loan plus minimal fees flexible payments. Your refinance mortgage broker will look at your current home mortgage and other debts you may have along with your income your household situation and your propertys. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

The borrowing capacity formula. This calculator helps you work out how much you can afford to borrow. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Unfortunately lenders wont let you borrow any old sum to buy a property. Each of us has a borrowing power this is essentially the maximum home loan amount you can borrow from a.

Usually this can be calculated as follows. However there can be a lot of variation in the way they assess your expenses with some lenders require adding a buffer that seriously impact the final amount youre eligible to borrow. Indeed it is a criterion taken into account by banks in their decision to lend you money or not.

How Do You Calculate Borrowing Capacity. Do you own a home. You can borrow up to 716000.

While there is a standard formula lenders follow. Calculating your borrowing capacity implies collateral or security loan as well. View your borrowing capacity and estimated home loan repayments.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Your borrowing capacity is the maximum amount lenders will loan to you. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

A 50000 deposit will get you a home loan of around 250000. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets. Your borrowing capacity is the total amount.

Lenders generally follow a basic formula to calculate your borrowing capacity.

Lvr Borrowing Capacity Calculator Interest Co Nz

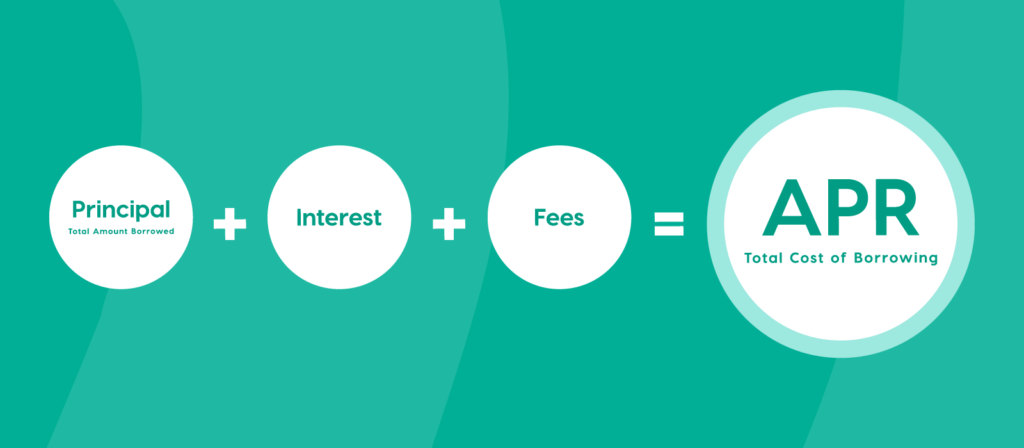

Learn The True Cost Of Borrowing Birchwood Credit

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

How To Improve Your Credit Score Improve Your Credit Score Emergency Fund Line Of Credit

Pin On Credit

Royal Bank Of Scotland Apply For A Loan How To Apply The Borrowers

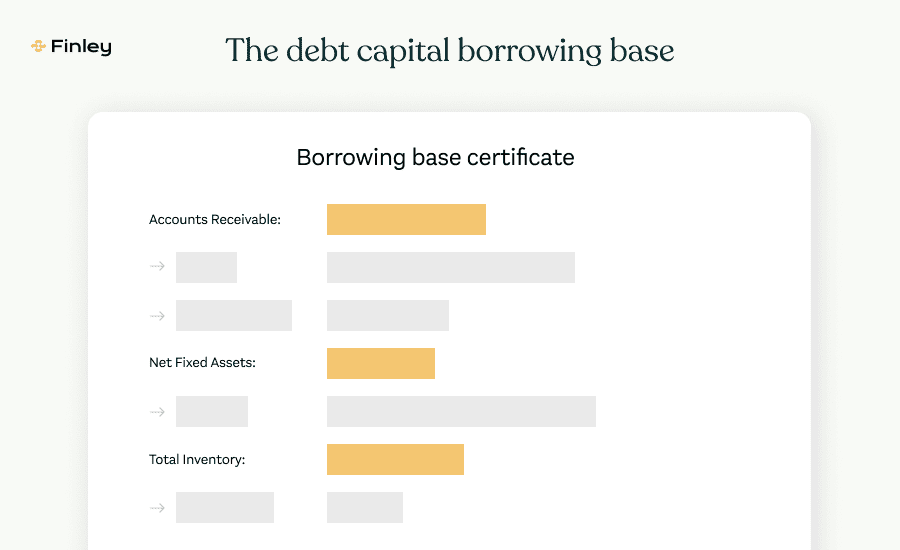

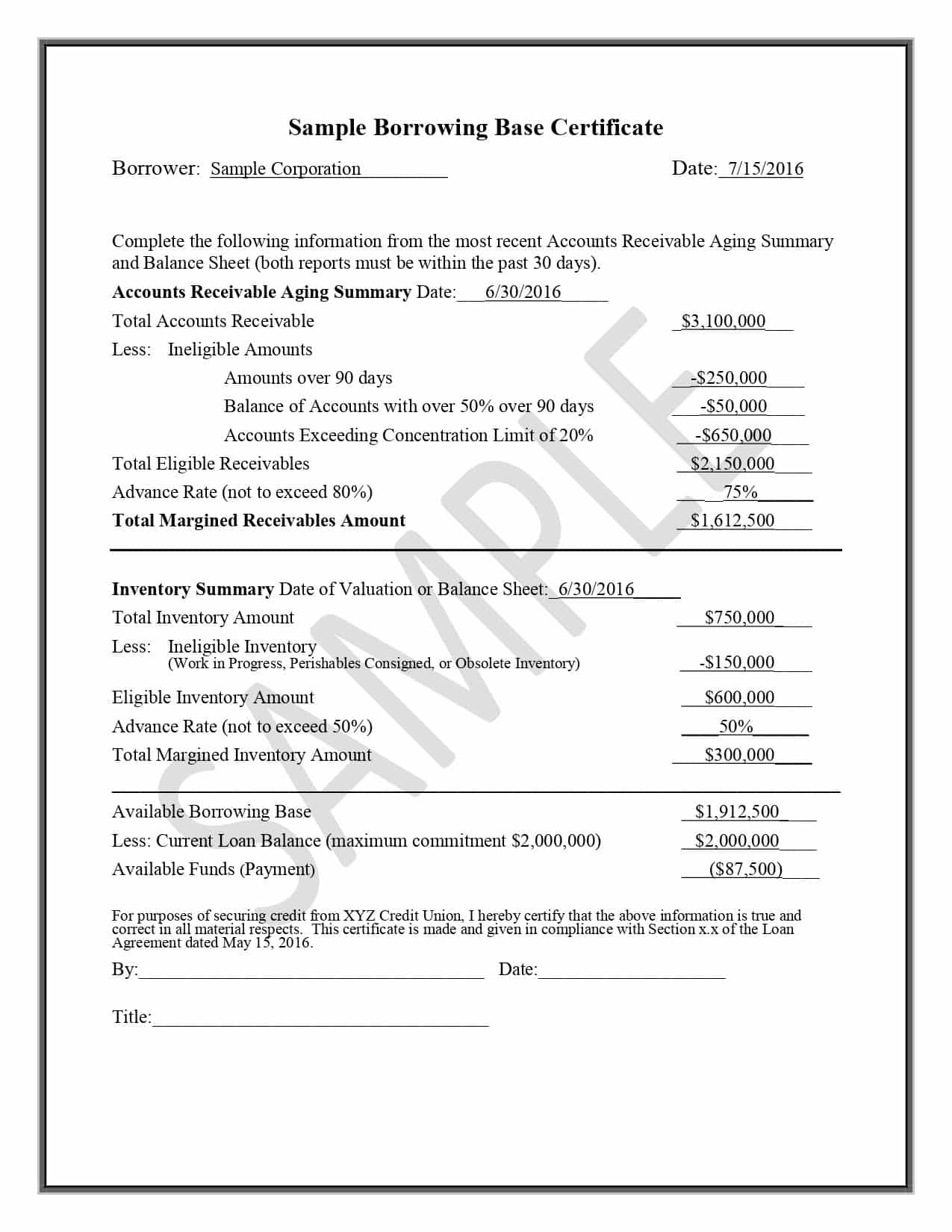

What Is A Borrowing Base

Are You Ready To Take Control Of Your Financial Life We Re Here To Help Financial Change Is All Interest Calculator Credit Card Interest Loan Interest Rates

A Collateral Mortgage Can Trap You Roseman Refinance Mortgage Refinancing Mortgage Mortgage Refinance Calculator

Hard To Borrow Fee Calculation Ally

Best Personal Loans For Good Credit Bad Credit In 2018

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Borrowing Base What It Is How To Calculate It

Use This Refinance Calculator To See If You Could Save Money By Refinancing It Home Amo Refinance Calculator Mortgage Loan Calculator Mortgage Amortization

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

Borrowing Base What It Is How To Calculate It

Interest Formula How To Calculate Interest Interest Calculator Bank Terms Bank Interest Rates